- Washington Elementary School District

- Health Benefits

- Health Savings Account

Human Resources

Page Navigation

- Home

- EMPLOYMENT

- APPLY NOW

- Certification

- Compensation and Staffing

- Health Benefits

- HR Training

-

Substitute Services

- Absence Management System Instructions

- Substitute Acknowledgment and Preference Form

-

Substitute Guide

- Certification and Fingerprint

- Contacts

- Emergency Information

- ESS Quick Tips

- Evacuation and Lockdown Procedures

- Frontline Mobile App - Absence Management

- Half-day Time List

- Half/Full Day Definitions and Supplemental Absences

- Inactivation & Cancellation of Assignments

- Job Description

- Pay Rates

- Policies and Regulations

- Professional Development & School Climate

- School Discipline and Problem Solving

- School Time Schedule

- Substitute Teacher Activities

- WESD Cares

Health Savings Account

-

Employees enrolled in the District's HDHP Plan are dually enrolled in a health savings account. A health savings account (HSA) is a tax-free savings account that belongs to you. You can use your HSA to pay for your insurance deductible and qualified out-of-pocket medical expenses. An HSA works along with a lower-premium, higher-deductible medical plan to cover your major medical expenses. You can use a health savings account to pay for qualified medical expenses, or you can save it and let it grow with tax-free interest from year to year.

The District makes a $480 annual contribution to an employee’s account (prorated based on the employee’s effective date) and employees may also elect to make their own contributions.HSA Tax FormsEach year, Optum Bank distributes tax forms for members to assist with filing taxes. The tax forms are issued based on the members' electronic records setting. Based on the members' setting, the forms will either be mailed to their home or be made available through the member portal on www.OptumBank.comForm 1099-SA reports distributions form an HSA. This form will be available in January and will need to be filed with a member's tax return.Form 5498-SA reports contributions into an HSA. This form is for informational purposes only and will be issued.HSA Plan Features

- Savings are not lost if not spent (whereas money you put in an FSA may be forfeited if not spent).

- You don’t have to pay taxes on withdrawals for eligible medical expenses (like a 401k).

- Even if you lose your qualified medical plan, the remaining funds in your HSA can be used for qualified medical expenses.

- You take the account with you when you change jobs, retire or leave your qualified health plan.

- HSA savings can grow just like other savings accounts, by earned interest or investments.

- HSA funds can be withdrawn with no penalty after age 65.

HSA Provider

The District's Health Savings Account (HSA) is administered by Optum Bank. HSA holders receive an HSA debit card that can be used at participating pharmacies and drug stores.

-

Get the most from your health benefit accounts

Whether you're new to our app or a current user, we'll help you get more out of your health accounts.

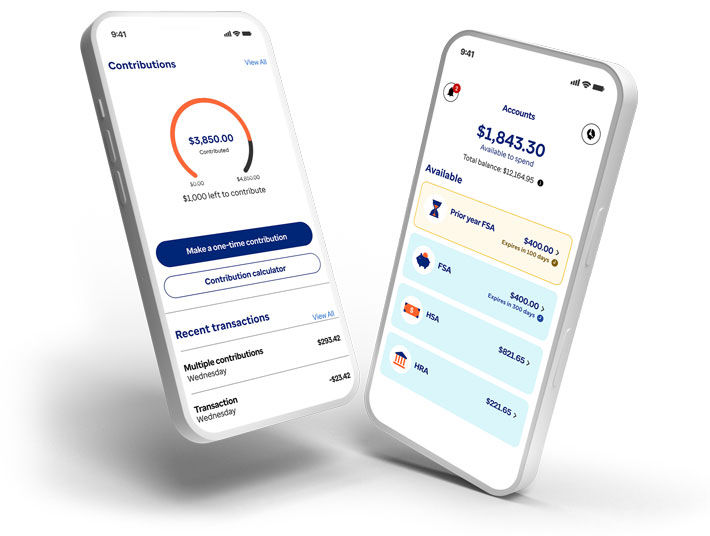

View your health accounts from anywhere

See account balances, make a contribution and view spending and saving transactions.

Did someone say shopping? Yes, we did

Learn what health costs are eligible, then shop and pay with your Optum card or digital wallet.

Pay bills, pay easily, pay yourself

Pay for health-related expenses, check and submit claims for reimbursement and easily capture receipts.

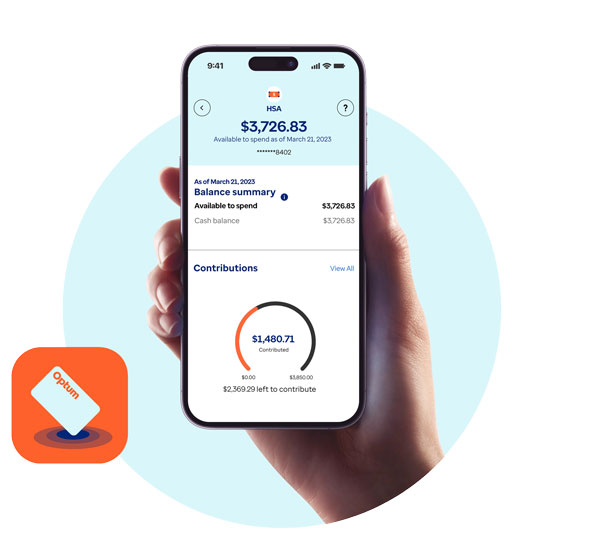

Paying with your health account has never been easier

Tap into the power of digital wallet

Pay for everything from copays and cough medicine to acupuncture and acne meds with just a tap of your smartphone.

Unlock your health dollars today

Why wait? Get the app and make your health dollars go further.

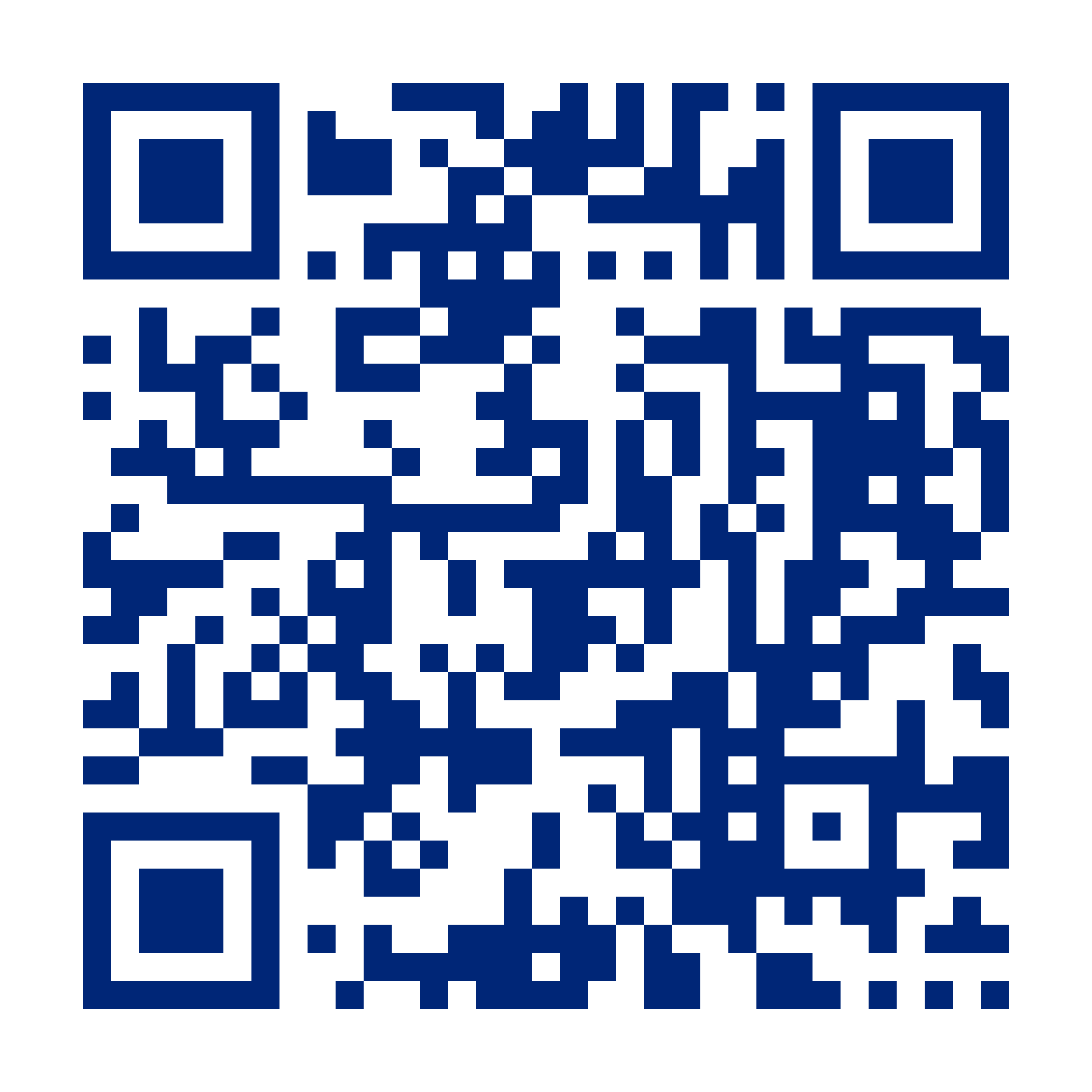

Scan to download the

Optum Bank appYour payment card is the fast, easy way to save on all kinds of everyday eligible health items.