Bond Information

Page Navigation

Bond Information

-

Bond project summary

Washington Elementary School District has worked diligently to complete the many projects that were in the Bond Plan approved by voters in November 2010. All proceeds have been received for this plan and most projects have been completed. A few projects remain that will be completed in 2018.

Thanks to voter approval of the 2016 Bond Election, the District has been able to begin work on the next group of planned projects. These projects include classroom technology, network infrastructure, school safety projects, building system replacements, renovations and some new construction. The projects identified in the 2016 Bond Plan are expected to continue through the year 2022.

Bond Ratings

For the May 2017 bond sale of $37,000,000, the district received an Aa3 rating from Moody’s and an A+ rating from S&P Global. Credit strengths cited in the reports were stable economy and enrollment trends, good financial performance, low per capita debt with rapid amortization, and a prudent and conservative management team. These credit ratings were held the same as the previous sale in May 2016. With these ratings WESD has experienced better interest rates when selling bonds.

Tax Rates

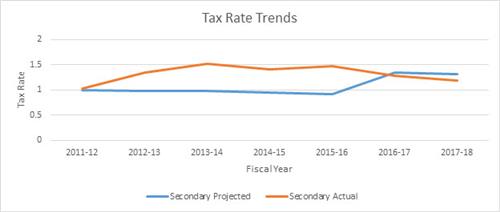

Bonds are funded with the levy of taxes on property within the district boundaries. The district has committed in both the 2010 and 2016 bond to strategically sell bonds in a manner that will maintain or lower the annual levy required to repay that bond debt. Our goal is to keep the tax rate for bonds at or below what was stated in the election pamphlet, but sometimes the fluctuation in home values affects the result as reflected on the chart below. For the years between 2011 and 2015, the assessed value of homes in the Washington Elementary School District boundaries decreased by about 46% - requiring a higher rate per $100 of value to fund the same amount of budget needed.